#Hyundai Portugal

Explore tagged Tumblr posts

Text

150.000€ en premios para la Copa Hyundai i20N Rallye en el SCER en 2024.

En el año 2024, veremos el lanzamiento de la Copa i20 N Rallye, una competición nueva diseñada especialmente para la Categoría N3. Esta emocionante copa estará presente en las seis citas de rally de asfalto del Supercampeonato de España, y es posible que también participe en un evento de la Copa de España de Rallyes de Asfalto. Esta nueva copa monomarca se llevará a cabo utilizando un i20 N de…

View On WordPress

#CERA#Hyundai#Hyundai Canarias#Hyundai Customer Racing#Hyundai España#hyundai i20#Hyundai i20 N#Hyundai i20 Rally2#Hyundai MSI#Hyundai Portugal#HyundaiMotorsport#Rally#RallyCar#RFEdA#SCER

1 note

·

View note

Text

Hydrogen Is the Future—or a Complete Mirage!

The green-hydrogen industry is a case study in the potential—for better and worse—of our new economic era.

— July 14, 2023 | Foreign Policy | By Adam Tooze

An employee of Air Liquide in front of an electrolyzer at the company's future hydrogen production facility of renewable hydrogen in Oberhausen, Germany, on May 2, 2023. Ina Fassbender/ AFP Via Getty Images

With the vast majority of the world’s governments committed to decarbonizing their economies in the next two generations, we are embarked on a voyage into the unknown. What was once an argument over carbon pricing and emissions trading has turned into an industrial policy race. Along the way there will be resistance and denial. There will also be breakthroughs and unexpected wins. The cost of solar and wind power has fallen spectacularly in the last 20 years. Battery-powered electric vehicles (EVs) have moved from fantasy to ubiquitous reality.

But alongside outright opposition and clear wins, we will also have to contend with situations that are murkier, with wishful thinking and motivated reasoning. As we search for technical solutions to the puzzle of decarbonization, we must beware the mirages of the energy transition.

On a desert trek a mirage can be fatal. Walk too far in the wrong direction, and there may be no way back. You succumb to exhaustion before you can find real water. On the other hand, if you don’t head toward what looks like an oasis, you cannot be sure that you will find another one in time.

Right now, we face a similar dilemma, a dilemma of huge proportions not with regard to H2O but one of its components, H2—hydrogen. Is hydrogen a key part of the world’s energy future or a dangerous fata morgana? It is a question on which tens of trillions of dollars in investment may end up hinging. And scale matters.

For decades, economists warned of the dangers of trying through industrial policy to pick winners. The risk is not just that you might fail, but that in doing so you incur costs. You commit real resources that foreclose other options. The lesson was once that we should leave it to the market. But that was a recipe for a less urgent time. The climate crisis gives us no time. We cannot avoid the challenge of choosing our energy future. As Chuck Sabel and David Victor argue in their important new book Fixing the Climate: Strategies for an Uncertain World, it is through local partnership and experimentation that we are most likely to find answers to these technical dilemmas. But, as the case of hydrogen demonstrates, we must beware the efforts of powerful vested interests to use radical technological visions to channel us toward what are in fact conservative and ruinously expensive options.

A green hydrogen plant built by Spanish company Iberdrola in Puertollano, Spain, on April 18, 2023. Valentine Bontemps/AFP Via Getty Images

In the energy future there are certain elements that seem clear. Electricity is going to play a much bigger role than ever before in our energy mix. But some very knotty problems remain. Can electricity suffice? How do you unleash the chemical reactions necessary to produce essential building blocks of modern life like fertilizer and cement without employing hydrocarbons and applying great heat? To smelt the 1.8 billion tons of steel we use every year, you need temperatures of almost 2,000 degrees Celsius. Can we get there without combustion? How do you power aircraft flying thousands of miles, tens of thousands of feet in the air? How do you propel giant container ships around the world? Electric motors and batteries can hardly suffice.

Hydrogen recommends itself as a solution because it burns very hot. And when it does, it releases only water. We know how to make hydrogen by running electric current through water. And we know how to generate electricity cleanly. Green hydrogen thus seems easily within reach. Alternatively, if hydrogen is manufactured using natural gas rather than electrolysis, the industrial facilities can be adapted to allow immediate, at-source CO2 capture. This kind of hydrogen is known as blue hydrogen.

Following this engineering logic, H2 is presented by its advocates as a Swiss army knife of the energy transition, a versatile adjunct to the basic strategy of electrifying everything. The question is whether H2 solutions, though they may be technically viable, make any sense from the point of view of the broader strategy of energy transition, or whether they might in fact be an expensive wrong turn.

Using hydrogen as an energy store is hugely inefficient. With current technology producing hydrogen from water by way of electrolysis consumes vastly more energy than will be stored and ultimately released by burning the hydrogen. Why not use the same electricity to generate the heat or drive a motor directly? The necessary electrolysis equipment is expensive. And though hydrogen may burn cleanly, as a fuel it is inconvenient because of its corrosive properties, its low energy per unit of volume, and its tendency to explode. Storing and moving hydrogen around will require huge investment in shipping facilities, pipelines, filling stations, or facilities to convert hydrogen into the more stable form of ammonia.

The kind of schemes pushed by hydrogen’s lobbyists foresee annual consumption rising by 2050 to more than 600 million tons per annum, compared to 100 million tons today. This would consume a huge share of green electricity production. In a scenario favored by the Hydrogen Council, of the United States’ 2,900 gigawatts of renewable energy production, 650 gigawatts would be consumed by hydrogen electrolysis. That is almost three times the total capacity of renewable power installed today.

The costs will be gigantic. The cost for a hydrogen build-out over coming decades could run into the tens of trillions of dollars. Added to which, to work as a system, the investment in hydrogen production, transport, and consumption will have to be undertaken simultaneously.

Little wonder, perhaps, that though the vision of the “hydrogen economy” as an integrated economic and technical system has been around for half a century, we have precious little actual experience with hydrogen fuel. Indeed, there is an entire cottage industry of hydrogen skeptics. The most vocal of these is Michael Liebreich, whose consultancy has popularized the so-called hydrogen ladder, designed to highlight how unrealistic many of them are. If one follows the Liebreich analysis, the vast majority of proposed hydrogen uses in transport and industrial heating are, in fact, unrealistic due to their sheer inefficiency. In each case there is an obvious alternative, most of them including the direct application of electricity.

Technicians work on the construction of a hydrogen bus at a plant in Albi, France, on March 4, 2021. Georges Gobet/AFP Via Getty Images

Nevertheless, in the last six years a huge coalition of national governments and industrial interests has assembled around the promise of a hydrogen-based economy.

The Hydrogen Council boasts corporate sponsors ranging from Airbus and Aramco to BMW, Daimler Truck, Honda, Toyota and Hyundai, Siemens, Shell, and Microsoft. The national governments of Japan, South Korea, the EU, the U.K., the U.S., and China all have hydrogen strategies. There are new project announcements regularly. Experimental shipments of ammonia have docked in Japan. The EU is planning an elaborate network of pipelines, known as the hydrogen backbone. All told, the Hydrogen Council counts $320 billion in hydrogen projects announced around the world.

Given the fact that many new uses of hydrogen are untested, and given the skepticism among many influential energy economists and engineers, it is reasonable to ask what motivates this wave of commitments to the hydrogen vision.

In technological terms, hydrogen may represent a shimmering image of possibility on a distant horizon, but in political economy terms, it has a more immediate role. It is a route through which existing fossil fuel interests can imagine a place for themselves in the new energy future. The presence of oil majors and energy companies in the ranks of the Hydrogen Council is not coincidental. Hydrogen enables natural gas suppliers to imagine that they can transition their facilities to green fuels. Makers of combustion engines and gas turbines can conceive of burning hydrogen instead. Storing hydrogen or ammonia like gas or oil promises a solution to the issues of intermittency in renewable power generation and may extend the life of gas turbine power stations. For governments around the world, a more familiar technology than one largely based on solar panels, windmills, and batteries is a way of calming nerves about the transformation they have notionally signed up for.

Looking at several key geographies in which hydrogen projects are currently being discussed offers a compound psychological portrait of the common moment of global uncertainty.

A worker at the Fukushima Hydrogen Energy Research Field, a test facility that produces hydrogen from renewable energy, in Fukushima, Japan, on Feb. 15, 2023. Richard A. Brooks/AFP Via Getty Images

The first country to formulate a national hydrogen strategy was Japan. Japan has long pioneered exotic energy solutions. Since undersea pipelines to Japan are impractical, it was Japanese demand that gave life to the seaborne market for liquefied natural gas (LNG). What motivated the hydrogen turn in 2017 was a combination of post-Fukushima shock, perennial anxiety about energy security, and a long-standing commitment to hydrogen by key Japanese car manufacturers. Though Toyota, the world’s no. 1 car producer, pioneered the hybrid in the form of the ubiquitous Prius, it has been slow to commit to full electric. The same is true for the other East Asian car producers—Honda, Nissan, and South Korea’s Hyundai. In the face of fierce competition from cheap Chinese electric vehicles, they embrace a government commitment to hydrogen, which in the view of many experts concentrates on precisely the wrong areas i.e. transport and electricity generation, rather than industrial applications.

The prospect of a substantial East Asian import demand for hydrogen encourages the economists at the Hydrogen Council to imagine a global trade in hydrogen that essentially mirrors the existing oil and gas markets. These have historically centered on flows of hydrocarbons from key producing regions such as North Africa, the Middle East, and North America to importers in Europe and Asia. Fracked natural gas converted into LNG is following this same route. And it seems possible that hydrogen and ammonia derived from hydrogen may do the same.

CF Industries, the United States’ largest producer of ammonia, has finalized a deal to ship blue ammonia to Japan’s largest power utility for use alongside oil and gas in power generation. The CO2 storage that makes the ammonia blue rather than gray has been contracted between CF Industries and U.S. oil giant Exxon. A highly defensive strategy in Japan thus serves to provide a market for a conservative vision of the energy transition in the United Sates as well. Meanwhile, Saudi Aramco, by far the world’s largest oil company, is touting shipments of blue ammonia, which it hopes to deliver to Japan or East Asia. Though the cost in terms of energy content is the equivalent of around $250 per barrel of oil, Aramco hopes to ship 11 million tons of blue ammonia to world markets by 2030.

To get through the current gas crisis, EU nations have concluded LNG deals with both the Gulf states and the United States. Beyond LNG, it is also fully committed to the hydrogen bandwagon. And again, this follows a defensive logic. The aim is to use green or blue hydrogen or ammonia to find a new niche for European heavy industry, which is otherwise at risk of being entirely knocked out of world markets by high energy prices and Europe’s carbon levy.

The European steel industry today accounts for less than ten percent of global production. It is a leader in green innovation. And the world will need technological first-movers to shake up the fossil-fuel dependent incumbents, notably in China. But whether this justifies Europe’s enormous commitment to hydrogen is another question. It seems motivated more by the desire to hold up the process of deindustrialization and worries about working-class voters drifting into the arms of populists, than by a forward looking strategic calculus.

In the Netherlands, regions that have hitherto served as hubs for global natural gas trading are now competing for designation as Europe’s “hydrogen valley.” In June, German Chancellor Olaf Scholz and Italian Prime Minister Giorgia Meloni inked the contract on the SoutH2 Corridor, a pipeline that will carry H2 up the Italian peninsula to Austria and southern Germany. Meanwhile, France has pushed Spain into agreeing to a subsea hydrogen connection rather than a natural gas pipeline over the Pyrenees. Spain and Portugal have ample LNG terminal capacity. But Spain’s solar and wind potential also make it Europe’s natural site for green hydrogen production and a “green hydrogen” pipe, regardless of its eventual uses, in the words of one commentator looks “less pharaonic and fossil-filled” than the original natural gas proposal.

A hydrogen-powered train is refilled by a mobile hydrogen filling station at the Siemens test site in Wegberg, Germany, on Sept. 9, 2022. Bernd/AFP Via Getty Images

How much hydrogen will actually be produced in Europe remains an open question. Proximity to the point of consumption and the low capital costs of investment in Europe speak in favor of local production. But one of the reasons that hydrogen projects appeal to European strategists is that they offer a new vision of European-African cooperation. Given demographic trends and migration pressure, Europe desperately needs to believe that it has a promising African strategy. Africa’s potential for renewable electricity generation is spectacular. Germany has recently entered into a hydrogen partnership with Namibia. But this raises new questions.

First and foremost, where will a largely desert country source the water for electrolysis? Secondly, will Namibia export only hydrogen, ammonia, or some of the industrial products made with the green inputs? It would be advantageous for Namibia to develop a heavy-chemicals and iron-smelting industry. But from Germany’s point of view, that might well defeat the object, which is precisely to provide affordable green energy with which to keep industrial jobs in Europe.

A variety of conservative motives thus converge in the hydrogen coalition. Most explicit of all is the case of post-Brexit Britain. Once a leader in the exit from coal, enabled by a “dash for gas” and offshore wind, the U.K. has recently hit an impasse. Hard-to-abate sectors like household heating, which in the U.K. is heavily dependent on natural gas, require massive investments in electrification, notably in heat pumps. These are expensive. In the United Kingdom, the beleaguered Tory government, which has presided over a decade of stagnating real incomes, is considering as an alternative the widespread introduction of hydrogen for domestic heating. Among energy experts this idea is widely regarded as an impractical boondoggle for the gas industry that defers the eventual and inevitable electrification at the expense of prolonged household emissions. But from the point of view of politics, it has the attraction that it costs relatively less per household to replace natural gas with hydrogen.

Employees work on the assembly line of fuel cell electric vehicles powered by hydrogen at a factory in Qingdao, Shandong province, China, on March 29, 2022. VCG Via Getty Images

As this brief tour suggests, there is every reason to fear that tens of billions of dollars in subsidies, vast amounts of political capital, and precious time are being invested in “green” energy investments, the main attraction of which is that they minimize change and perpetuate as far as possible the existing patterns of the hydrocarbon energy system. This is not greenwashing in the simple sense of rebadging or mislabeling. If carried through, it is far more substantial than that. It will build ships and put pipes in the ground. It will consume huge amounts of desperately scarce green electricity. And this faces us with a dilemma.

In confronting the challenge of the energy transition, we need a bias for action. We need to experiment. There is every reason to trust in learning-curve effects. Electrolyzers, for instance, will get more affordable, reducing the costs of hydrogen production. At certain times and in certain places, green power may well become so abundant that pouring it into electrolysis makes sense. And even if many hydrogen projects do not succeed, that may be a risk worth taking. We will likely learn new techniques in the process. In facing the uncertainties of the energy transition, we need to cultivate a tolerance for failure. Furthermore, even if hydrogen is a prime example of corporate log-rolling, we should presumably welcome the broadening of the green coalition to include powerful fossil fuel interests.

The real and inescapable tradeoff arises when we commit scarce resources—both real and political—to the hydrogen dream. The limits of public tolerance for the costs of the energy transition are already abundantly apparent, in Asia and Europe as well as in the United States. Pumping money into subsidies that generate huge economies of scale and cost reductions is one thing. Wasting money on lame-duck projects with little prospect of success is quite another. What is at stake is ultimately the legitimacy of the energy transition as such.

In the end, there is no patented method distinguishing self-serving hype from real opportunity. There is no alternative but to subject competing claims to intense public, scientific, and technical scrutiny. And if the ship has already sailed and subsidies are already on the table, then retrospective cost-benefit assessment is called for.

Ideally, the approach should be piecemeal and stepwise, and in this regard the crucial thing to note about hydrogen is that to regard it as a futuristic fantasy is itself misguided. We already live in a hydrogen-based world. Two key sectors of modern industry could not operate without it. Oil refining relies on hydrogen, as does the production of fertilizer by the Haber-Bosch process on which we depend for roughly half of our food production. These two sectors generate the bulk of the demand for the masses of hydrogen we currently consume.

We may not need 600 million, 500 million, or even 300 million tons of green and blue hydrogen by 2050. But we currently use about 100 million, and of that total, barely 1 million is clean. It is around that core that hydrogen experimentation should be concentrated, in places where an infrastructure already exists. This is challenging because transporting hydrogen is expensive, and many of the current points of use of hydrogen, notably in Europe, are not awash in cheap green power. But there are two places where the conditions for experimentation within the existing hydrogen economy seem most propitious.

One is China, and specifically northern China and Inner Mongolia, where China currently concentrates a large part of its immense production of fertilizer, cement, and much of its steel industry. China is leading the world in the installation of solar and wind power and is pioneering ultra-high-voltage transmission. Unlike Japan and South Korea, China has shown no particular enthusiasm for hydrogen. It is placing the biggest bet in the world on the more direct route to electrification by way of renewable generation and batteries. But China is already the largest and lowest-cost producer of electrolysis equipment. In 2022, China launched a modestly proportioned hydrogen strategy. In cooperation with the United Nations it has initiated an experiment with green fertilizer production, and who would bet against its chances of establishing a large-scale hydrogen energy system?

The other key player is the United States. After years of delay, the U.S. lags far behind in photovoltaics batteries, and offshore wind. But in hydrogen, and specifically in the adjoining states of Texas and Louisiana on the Gulf of Mexico, it has obvious advantages over any other location in the West. The United States is home to a giant petrochemicals complex. It is the only Western economy that can compete with India and China in fertilizer production. In Texas, there are actually more than 2500 kilometers of hardened hydrogen pipelines. And insofar as players like Exxon have a green energy strategy, it is carbon sequestration, which will be the technology needed for blue hydrogen production.

It is not by accident that America’s signature climate legislation, the Inflation Reduction Act, targeted its most generous subsidies—the most generous ever offered for green energy in the United States—on hydrogen production. The hydrogen lobby is hard at work, and it has turned Texas into the lowest-cost site for H2 production in the Western world. It is not a model one would want to see emulated anywhere else, but it may serve as a technology incubator that charts what is viable and what is not.

There is very good reason to suspect the motives of every player in the energy transition. Distinguishing true innovation from self-serving conservatism is going to be a key challenge in the new era in which we have to pick winners. We need to develop a culture of vigilance. But there are also good reasons to expect certain key features of the new to grow out of the old. Innovation is miraculous but it rarely falls like mana from heaven. As Sabel and Victor argue in their book, it grows from within expert technical communities with powerful vested interests in change. The petrochemical complex of the Gulf of Mexico may seem an unlikely venue for the birth of a green new future, but it is only logical that the test of whether the hydrogen economy is a real possibility will be run at the heart of the existing hydrocarbon economy.

— Adam Tooze is a Columnist at Foreign Policy and a History Professor and the Director of the European Institute at Columbia University. He is the Author of Chartbook, a newsletter on Rconomics, Geopolitics, and History.

#Hydrogen#Battery-Powered Electric Vehicles (EVs)#Chuck Sabel | David Victor#Iberdrola Puertollano Spain 🇪🇸#Green Hydrogen#Hydrogen Council of the United States 🇺🇸#Hydrogen Economy#Airbus | Aramco | BMW | Daimler Truck | Honda | Toyota | Hyundai | Siemens | Shell | Microsoft#Japan 🇯🇵 | South Korea 🇰🇷 | EU 🇪🇺 | UK 🇬🇧 | US 🇺🇸 | China 🇨🇳#Portugal 🇵🇹 | Germany 🇩🇪 | Namibia 🇳🇦#European-African Cooperation

2 notes

·

View notes

Text

FINALLY, RALLY PORTUGAL!! 🇵🇹

hoping for good results for Thierry Neuville (and Oliver Solberg in WRC2)💪💪

1 note

·

View note

Text

Pick a Novel: Keywords/prominent themes in your life

Pick the novel that draws your attention the most. If you can't decide between two, then look at the 2 readings. This is a general reading, so not everything will apply. Please take what resonates and leave what doesn't behind!

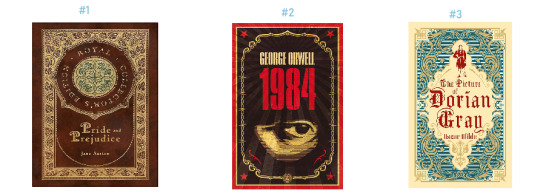

#1

Keywords: love, lust, passion, fun, temperament, cafe, sweet, bicycle, pen, books, music, loyalty, winter, sofa, furniture, thoughts, light, intuition, soulmate, art, obsidian, cake, carbonated water, skincare, socks, cooking

Celebrities/Public Figures: Audrey Hepburn, Min Yoongi, IU, Claude Monet, Angela Merkel, Andrew Carnegie, John Johnson, Mark Zuckerberg, Larry Page, Howard Schultz, Sam Walton, Amancio Ortega, Queen Elizabeth I, Jane Austen, Jennie Kim

Countries: Italy, Canada, South Africa, Thailand, Saudi Arabia, Singapore, Greece, Madagascar, Qatar, Sweden, Zambia, Taiwan, Solomon Islands

Numbers: 11, 1, 5, 9, 80, 888, 6

Brands: Hermes, Tiffany, Apple, Instagram, Taobao, Lamborghini, Deloitte, Microsoft, Chopard, Givenchy, Patek Phillipe, Chloe, Alaia, Kraft,

Kpop songs: Young Forever by BTS, Shine by PENTAGON, Me Gustas Tu by GFRIEND, Run to You by DJ DOC, Love Lee by AKMU, Deja vu by TXT, Back Down by P1Harmony, Love shot by EXO

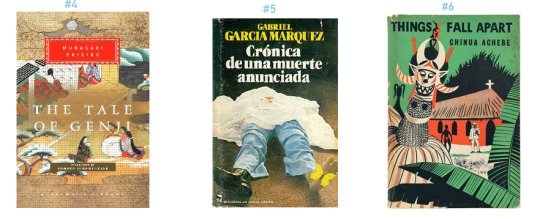

#2

Keywords: economy, job loss, new opportunities, play, drama, anger, frustration, lost, compass, computers, battery, feet, head, brain, summer, pearl, avocado, junk food, fried chicken, challenge, frugal

Celebrities/Public Figures: Grace Kelly, Billie Eilish, Keanu Reeves, Rosé, Jung Hoseok, Salma Hayek, Pablo Picasso, Princess Diana, Thomas Edison, Sergey Brin, Mary I, William Shakespeare, Lee Nayeon

Countries: New Zealand, USA, Maldives, Indonesia, United Kingdom, Venezuela, Lithuania, Nepal, Portugal, Poland, Lebanon, Mali, Netherlands

Numbers: 4, 99, 101, 33, 13, 14, 0

Brands: Masion Margiela, Amazon, facebook, Shein, PWC, Missoni, Moschino Couture, Toyota, citi bank, Chaumet, Polene, Pizza Hut,

Kpop songs: Love Dive by IVE, Shangri-la by VIXX, Sweety by Clazziquai, I NEED U by BTS, The Chaser by Infinite, Magnetic by ILLIT, My House by 2PM, ICY by ITZY

#3

Keywords: tales, gossip, lies, funny, movies, theatre, cell phone, cool, kpop, magenta, ancient, history, claws, cats, tiger, fall, jealousy, games, aquamarine, lemons, makeup, pencil, groceries

Celebrities/Public Figures: Beyonce, Lady Gaga, Morgan Freeman, Kim Seokjin, Jang Wonyoung, Matt Damon, Napoleon Bonaparte, Shinzo Abe, Steve Jobs, Voltaire, Kim Jisoo,

Countries: Ethiopia, France, Russia, Ireland, Argentina, Afghanistan, Libya, Rwanda, Nigeria, Pakistan, Morocco, Malta, Kazakhstan, Kenya, Iraq,

Numbers: 2, 7, 69, 25, 55, 79, 1182

Brands: Saint Laurent, miumiu, Starbucks, Mercedez-Benz, Nestle, Oracle, Tod's, Bulgari, Rolex, KFC, SUBWAY, Carrefour, Kellog's

Kpop songs: Supernova by aespa, Maestro by seventeen, Not by the moon by GOT7, Alone by Sistar, Hip by MAMAMOO, Good Day by IU, Bite Me by ENHYPEN, Work by ATEEZ, The Feels by TWICE

#4

Keywords: foreign, spicy, peppery, rice, no, objection, resistance, control, storms, thunderstorms, shower, tension, crush, pop, paper, mango, legs, fragrance, emerald, clothing rack, tomatoes, defeat,

Celebrities/Public Figures: Judy Garland, Margot Robbie, G-Dragon, Jeon Jungkook, Pharrell Williams, Emmanuel Macron, Bill Clinton, King Charles, Warren Buffet, Cleopatra, Kim Mingyu

Countries: South Korea, Philippines, Scotland, Spain, Albania, Guatemala, Malaysia, Iran, Romania, Honduras, Georgia, Croatia, Belgium, Czech Republic, Gambia, Guinea

Numbers: 31, 75, 412, 43, 486, 640

Brands: Chanel, Prada, Bentley, Gucci, Samsung, Disney, BMW, Hyundai, cisco, Van Cleefs & Arpels, Dior, Loro Piana, Shake Shack

Kpop songs: Gee by SNSD, If you by BIGBANG, Antifragile by LE SSERAFIM, Up and Down by EXID, OMG by NewJeans, Lion by (G)I-DLE, Hello by TREASURE,

#5

Keywords: death, mystery, mirror, reflection, shadow, black, grey, white, funeral, video, sprint, pool, gym, streets, metro, subway, chocolate, broken, knees, moon, ruby, surgery, teeth, race

Celebrities/Public Figures: Marilyn Monroe, Barack Obama, Kate Winslet, Kim Taehyung, Aamir Khan, Marie Antoinette, Elon Musk, Robert F Kennedy, Jeff Bezos, Richard Branson, Edward VIII, Charles Dickens, Abraham Lincoln, Park Bogum,

Countries: North Korea, China, Vietnam, Brazil, Bangladesh, Cambodia, Germany, India, Israel, Laos, Haiti, Dominican Republic, Congo, Cuba, Egypt, Mongolia

Numbers: 3, 97, 17, 19, 52, 98

Brands: Ralph Lauren, Celine, Ferrari, Huawei, Uber, intel, UPS, Calvin Klein, Piaget, Guerlain, Berluti, Pepsi, Cadbury

Kpop songs: Shut down by Blackpink, Seven by Jeon Jungkook, God's Menu by Stray Kids, Love Love Love by Epik High, Very Nice by SEVENTEEN, Birthday by Jeon Somi, Psycho by Red Velvet,

#6

Keywords: travel, toxic, break away, departure, memory, dreams, truth, unveil, diary, journal, coffee, jacket, shoes, hands, social media, news, competition, autumn, diamonds, electricity, TV, cheat, fashion

Celebrities/Public Figures: Jane Birkin, Kim Jiwon, Gigi Hadid, Charlize Theron, Park Jimin, Salman bin Abdulaziz Al Saud, Maximilien Robespierre, Bill Gates, Queen Elizabeth II, Vladimir Putin, Henry Ford, James Joyce, Lalisa Manobal

Countries: Japan, Australia, Mexico, Iceland, Finland, Eritrea, Ecuador, Costa Rica, Cyprus, Bolivia, Botswana, Bahamas,

Numbers: 8, 646, 152, 37, 49, 22

Brands: Louis Vuitton, Lexus, Tesla, Fendi, Walmart, Nike, Siemens, Google, Cartier, Burberry, Ferragamo, Burger King, Unilever

Kpop songs: ROCKSTAR by LISA, Cherry bomb by NCT 127, Move by Taemin, Dramarama by MONSTA X, Love Scenario by iKON, Get a Guitar by RIIZE, Replay by SHINee, Candy Sugar Pop by ASTRO, Mr. Simple by Super Junior

#psychic readings#love readings#psychic predictions#general readings#psychic#psychic reading#pac#pick a card#pac reading#pick a card reading#pick a pile#pick a picture#pick a photo#psychic reader#psychic readers#free psychic reading#life readings#predictions#intuitive#intuition#intutive reading

229 notes

·

View notes

Text

WRC Portugal resultado dia 1

Top 10

1-8-Tanak\Jarveoja-Hyundai I20 N Rally 1-Hyundai Sheel Mobis WRT-1:41:26.2

2-17-Ogier\Landais-Toyota GR Yaris Rally 1-Toyota Gazzo Racing WRT-1:41:33.2

3-18-Katsuta\Jhonsson--Toyota GR Yaris Rally 1-Toyota Gazzo Racing WRT-1:41:53.2

4-69-Rovanpera\Haltunen-Toyota GR Yaris Rally 1-Toyota Gazzo Racing WRT-1:41:54.5

5-1-Neuville\Wydaeghe-Hyundai I20 N Rally 1-Hyundai Sheel Mobis WRT-1:41:58.9

6-5-Pajeri\Salminen-Toyota GR Yaris Rally 1-Toyota Gazzo Racing WRT 2-1:42:27.6

7-33-Evans\Martin-Toyota GR Yaris Rally 1-Toyota Gazzo Racing WRT-1:42:35.2

8-13-Munster\Louka-Ford Puma Rally 1-M-Sport Ford-1:43:16.4

9-55-McLean\Eoin-Ford Puma Rally 1-M-Sport Ford-1:43:20.5

10-20-Solberg\Eliott-Toyota GR Yaris Rally 2-Printsport-WRC 2-1:45:04.4

WRC 2

1-20-Solberg\Eliott-Toyota GR Yaris Rally 2-Printsport-1:45:04.4

2-23-Greensmith\Andersson-Skoda Fabia RS Rally 2-1:45:57.9

3-21-Y.Rossel\Arnaud-Citroen C3 Rally 2-PH-Sport-1:46:00.1

O navegador Brasileiro Gabriel Morales correndo com o Boliviano Bruno Bulancia terminou na 17º posição na categoria Challenger na 13º

0 notes

Text

WRC - Diretta Rally del Portogallo

Dal 15 al 18 maggio si corre a Matosinhos il quinto round del Mondiale Rally. Toyota, Hyundai e M-Sport pronte alla sfida sugli insidiosi sterrati portoghesi. Tutto è pronto per il Vodafone Rally de Portugal, una delle tappe storiche e più attese del Campionato del Mondo Rally (WRC). La gara, valida anche per il FIA Junior WRC e per il Campionato Portoghese Rally (CPR), si disputerà dal 15 al 18…

0 notes

Text

Hyundai Motorsport Aims for Success at 2025 Rally de Portugal

Hyundai Motorsport is setting its sights on achieving a commendable overall performance during the fifth round of the 2025 FIA World Rally Championship (WRC) season, known as the Rally de Portugal, scheduled for May 15-18. The team hopes to demonstrate enhanced capabilities at this gravel event, where both Thierry Neuville and Ott Tänak have previously celebrated victories. Team Strategy and…

1 note

·

View note

Text

The Cost of Charging an Electric Car in Each European Country, Illustrated in a Revealing Graphic

Spain ranks on the cheaper side of the list, although prices in countries like Norway stand out.

The Key is Renewable Energy

Opting for an electric car is very appealing due to its advanced technology and its direct benefit to the environment. Moreover, if we choose the right charging point, it can also be good for our wallet (especially if we have a home charging system powered by solar panels). This is a crucial factor when deciding on an electric vehicle, as both the charging network and the price to pay come into play, which varies significantly from one country to another.

In a graphic created by Visual Capitalist, it is clearly shown which European countries pay the most when charging their electric cars — and which pay the least.

The Data Iceland pays the least to charge an electric car, while Norway pays the most, with a significant difference compared to the vast majority of other European countries. This data comes from the European Alternative Fuels Observatory as of 2024, and Visual Capitalist has used data for a Tesla Model 3 to create the graphic.

The EAFO also allows for comparisons of the cost to charge other vehicles, such as the Honda e, Nissan Leaf, Dacia Spring Electric, Fiat 500e, Hyundai Kona Electric, XPENG P5, or Volkswagen ID.3 Pro S, with prices varying widely depending on each vehicle’s charging power.

Diverse Costs Taking this into account, and considering a charging time of 25 minutes, we find that Iceland, Portugal, and Finland are the cheapest countries, paying less than five euros for 100 kilometers of range. In this case, Spain is comfortably positioned with an average cost of 7.1 euros per 100 kilometers. At the other end of the list are Slovenia and Norway, with prices of 17 and 18.9 euros, respectively — by far the most expensive.

However, Norway’s case is interesting because it has the highest price on the list, but it is also a country that has wholeheartedly embraced electric vehicles. In 2020, 54% of new car sales in the country were electric. By 2024, that figure has risen to 84%, and it is expected that by 2025, 100% of new car sales will be electric or hydrogen-powered.

Renewables Play Their Role Interestingly, several factors influence the cost of charging an electric car in each country. Generally, countries with more renewable energy sources tend to have cheaper charging prices. There are other countries, like Germany, that are heavily investing in these energy sources, yet they still face high energy import prices, which is reflected in the cost of charging.

In the end, many factors need to be considered when making these calculations, including taxes, energy sources, the aforementioned investment in renewables, and energy prices within each country.

Challenges Looking at the graphic, and seeing that Spain fares well in terms of the euro/kilometer ratio, it makes one want to go for an electric vehicle. The problem here is not so much autonomy (with cars starting to meet expectations in this regard) but rather the availability of public charging points. In cities, this usually isn’t a problem, but in some parts of the country, they are scarce, and it is vital to check the route we want to take to know where those charging points are located. This is why 30% of electric vehicle buyers miss gasoline.

In this interactive map, you can see both charging points and the price per kilometer you want to achieve, but something that seems essential is that investment is needed to improve signage on roads, indicating charging points on highways and main roads. This is something they are already working on, but it seems to be a late response.

And, well, it’s also necessary for the plugs to work — something we’ve learned the hard way that isn’t always the case.

1 note

·

View note

Text

Vodafone Rally de Portugal: Ogier Rekor Kırdı, Neuville Güç Gösterdi

Dünya Ralli Şampiyonası’nın en çekişmeli yarışlarından biri olan Vodafone Rally de Portugal, Sébastien Ogier’in tarihi bir zaferle sonuçlandı. Fransız pilot, Portekiz’deki altıncı zaferini elde ederek Markku Alen ile paylaştığı rekoru geride bıraktı. Yarış, zorlu etaplar ve stratejik sürüşlerle doluydu, Hyundai ve Toyota arasındaki rekabet kıyasıya devam etti. Ogier Zaferle Tarihe Ge��ti Toyota…

View On WordPress

0 notes

Text

Brand of the bestselling car in Europe in 2023:

🇦🇱 Albania: VW

🇦🇹 Austria: Skoda

🇧🇾 Belarus: Geely

🇧🇪 Belgium: BMW

🇧🇦 Bosnia and Herzegovina: Skoda

🇧🇬 Bulgaria: Dacia

🇭🇷 Croatia: Renault

🇨🇿 Czech Republic: Skoda

🇩🇰 Denmark: Tesla

🇪🇪 Estonia: Toyota

🇫🇮 Finland: Tesla

🇫🇷 France: Renault

🇩🇪 Germany: VW

🇬🇷 Greece: Toyota

🇭🇺 Hungary: Suzuki

🇮🇸 Iceland: Tesla

🇮🇪 Ireland: Hyundai

🇮🇹 Italy: Fiat

🇱🇻 Latvia: Toyota

🇱🇹 Lithuania: Toyota

🇲🇩 Moldova: Dacia

🇲🇪 Montenegro: Dacia

🇳🇱 Netherlands: Tesla

🇳🇴 Norway: Tesla

🇵🇱 Poland: Toyota

🇵🇹 Portugal: Peugeot

🇷🇴 Romania: Dacia

🇷🇺 Russia: Lada

🇷🇸 Serbia: Skoda

🇸🇰 Slovakia: Skoda

🇪🇸 Spain: Dacia

🇸🇪 Sweden: Tesla

🇨🇭 Switzerland: Tesla

🇹🇷 Turkey: Fiat

🇺🇦 Ukraine: Toyota

🇬🇧 United Kingdom: Ford

1 note

·

View note

Text

Programação dias 22-26\01\2025

24h Daytona

1000 Milhas do Brasil

Rally de Monte Carlo

GT Winter Series-Algarve

E1 Series-Arabia Saudita

22\01-Quarta feira

12:00-Rally de Monte Carlo-WRC-Shakedown-Youtube

youtube

Quinta-feira-23\01

14:00-Rally de Monte Carlo-SS1-Sportv 4 Portugal

15:50-Rally de Monte Carlo-SS2-Sportv 4 Portugal

16:10-24h Daytona-Qualyfing-Youtube

youtube

16:53-Rally de Monte Carlo-SS3-Sportv 4 Portugal

19:25-Mazda MX5 CUP-Daytona-race 1\corrida 1-Youtube

youtube

Sexta-feira-24\01\2025

07:00-E1 Series-Qualyfing-Arabia Saudita-Youtube

youtube

07:42-Rally de Monte Carlo-SS6-Sportv 4 Portugal

10:30-E1 Series-Qualyfing Races-Arabia Saudita-Youtube

youtube

11:23-Rally de Monte Carlo-SS7,SS8 & SS9-Sportv 4 Portugal

14:15-1000 Milhas do Brasil-Interlagos-Qualyfing-Youtube

youtube

14:15-1000 Milhas do Brasil-Interlagos-Qualyfing-Youtube (em Italiano)

youtube

15:45-IMSA Pilot Challenge-Daytona-Youtube

youtube

Sabado-25\01

06:00-Rally de Monte Carlo-SS11 & SS12-Sportv4 Portugal

06:45-E1 Series-Semi finais-Arabia Saudita-Youtube

10:30-E1 Series-finais-Arabia Saudita-Youtube

12:50-GT Winter Series-Algarve-race 1-Youtube

13:30-Gold Classic-Interlagos-corrida 1-Youtube

14:00-24h Daytona-largada\start-Youtube IMSA\Youtube GP\GPTV

Domingo-26\01

00:00-1000 Milhas do Brasil-Interlagos-Youtube Race TV\Bandsports\Youtube Parc Ferm TV

00:00-1000 Milhas do Brasil Virtual-Interlagos-Youtube Pro Racing Simuladores

youtube

Brasileiros competindo

IMSA:Felipe Nasr(Porsche 963 #7), Felipe Drugovich(Cadillac V Series R #31), Pietro Fittipaldi(Oreca\Pratt Miller), Felipe Fraga, Felipe Massa(Oreca\Riley #74),Pipo Derani(Corvette C8 Z06 GT3 R #36), Daniel Serra(Ferrari 296 GT3 #35),Augusto Farfus (BMW M4 GT3), Custodio Toledo(Ferrari 296 GT3 #50)

IMSA Pilot Challenge: Celso Neto(Audi RS3 LMS TCR #7), Suelio Almeida(Hyundai Elantra N TCR)

#programação streaming & tv#imsa#24h daytona#rally de monte carlo#wrc#Youtube#1000 milhas do brasil#e1 series

0 notes

Text

WRC - Portogallo: sfida ad alta intensità

Quinto round del Mondiale, al via 95 equipaggi tra WRC, WRC2, WRC3 e Junior. Toyota, Hyundai e M-Sport pronte a confrontarsi sui duri sterrati lusitani. Il Vodafone Rally de Portugal si prepara ad accogliere 95 equipaggi per un’edizione che si annuncia tra le più dure degli ultimi anni. Non è solo una delle tappe più storiche e amate del calendario, ma anche un banco di prova severo per piloti,…

0 notes

Text

Vittoria di Kris Meeke alle Serras de Fafe

🔴 🔴 Vittoria di Kris Meeke alle Serras de Fafe

Inizio spettacolare del Campionato Rally Portoghese per Kris Meeke e James Fulton con la i20 Rally2 del team Hyundai Portugal. Meeke ha dominato la gara dall’inizio alla fine il Rally Serras de Fafe – Felgueiras – Boticas e Cabeceiras de Basto, ottenendo il miglior tempo in 9 degli 11 tratti cronometrati e terminando con un vantaggio di oltre un minuto. (Iscriviti gratuitamente al canale…

View On WordPress

0 notes

Text

63h35 pour traverser l’Europe en voiture électrique : l’Ioniq 6 bat le record de la Tesla Model 3

Ils sont partis de la pointe sud du Portugal pour atteindre le Cap Nord à bord d’une Hyundai Ioniq 6, 100 % électrique. L’équipage a englouti 5 665 km en

0 notes

Text

Iseul's words differed from the retired agent's spirits as she found she was very grateful that the younger woman agreed to be her date, then resolving she would try to show her, rather than tell. "I think you will like the city, I used to come here with my father and younger siblings. My father worked for Hyundai in Frankfurt-Rhine, but he loved German cars, especially BMW, so we would come down here and spend our weekend at the tracks." Her mother hated the weekends he shuffled them down there when she was working, moreso because he left them unattended most times with a pocket full of change to spend, but the siblings always found doings to amuse themselves. "Is there anything in particular you want to see?"

Sensing the anxiety rolling off her company, a warm hand came to lift up Iseul's chin as she spoke, "As we are on the groom's side I think I'll chalk it up to not giving a damn, but we'll be okay, trust me. They'll all be carping over the lovely couple as they want to keep the whole event relatively short so they can start their honeymoon." Ending that thought with a chaste kiss on the other's cheek, Hal poured them more drinks. "They're sailing off down to Portugal, and then the rest of the Mediterranean Sea. And really, I think Dries is just happy I brought anyone at all. They'll like you, my friends, and they have plenty of stories of their travels to match your own."

The invitation to a wedding with Halcombe raised a dozen questions for Iseul, all of which she was simply too shy to ask. The cartographer was equal parts delighted and flustered, but quick to accept. Sitting together in the beautiful apartment, Iseul kept looking over at Hal but biting her tongue every time another question arose. When Halcombe's hand slipped into hers she'd thought that the older woman had caught on to Iseul's mouth bobbing open and closed like a guppy until she spoke. She gave her hand a gentle squeeze, her thumb caressing Halcombe's slender fingers just a few times before she made her own patterns in Iseul's. "You don't need to thank me. I'm so glad that I came, so glad you invited me."

Iseul's soft smile found Halcombe's face, "Purists? What does that mean? Will they be mad you're bringing me?" She nibbled on her bottom lip, doe eyes blinking. "It's not going to be a problem is it, me being your date and us..." She looked around, "Staying together." Swallowing she looked back at Hal, her tongue darting across her lips. Not having any idea what they were and too afraid of rejection to express the fluttering of her heart, she waited for Halcombe's explanation in heart-racing silence.

9 notes

·

View notes

Text

Kris Meeke al Campeonato Portugués de Ralis.

El Team Hyundai Portugal ha confirmado la presencia del mundialista Kris Meeke acompañando al local Ricardo Teodosio en el CPR 2023 con sendos Hyundai i20 Rally2 como manera de rendir tributo al desaparecido Craig Breen. Después de mucha deliberación, Hyundai Portugal decidió invitar a Kris Meeke, un viejo amigo de Craig, a tomar su lugar en el equipo Hyundae Portugal en RCP. Kris Meeke, un…

View On WordPress

#Aboboreira#CPR#Cyril Abiteboul Hyundai#ERC#Hyundai#Hyundai Customer Racing#Hyundai España#Hyundai i20 N#Hyundai i20 Rally2#Hyundai Kona#Hyundai Meeke#Hyundai motorsport#Hyundai Portugal#Hyundai R5#Hyundai WRC#HyundaiMotorsport#Kris Meeke#Meeke#Meeke Hyundai#Meeke Portugal#Rally#RallyCar#Sports & You#Team Hyundai Portugal#Test Hyundai#WRC

0 notes